Held Deposits

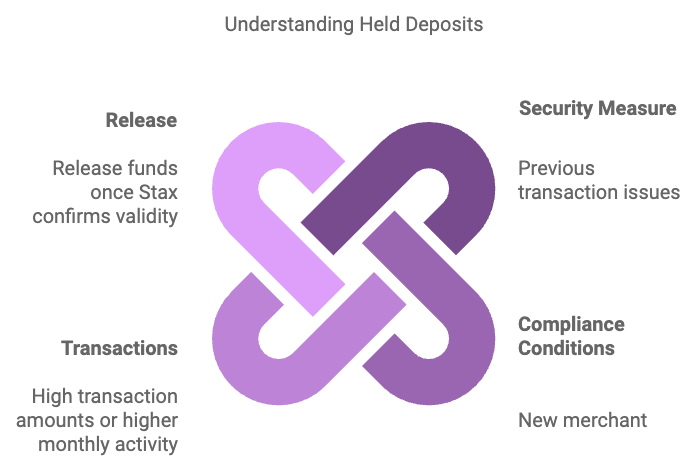

Two primary reasons exist for placing an account on a temporary risk hold.

- Exceeding the high ticket (transaction) or average ticket amount established during your account's underwriting.

- Some accounts, typically those with no previous card acceptance history, are conditionally approved, requiring that the first batch has select transactions verified.

Stax provides funding for your transactions after a sale and then waits to collect that money from the cardholder’s bank. In this regard, your account with us works as a line of credit, and as such, there is an inherent risk for us as a processor. Fraudulent merchant accounts and chargebacks make up most of our losses, but our underwriting and risk management processes can help minimize those losses.

When chargebacks occur, funds are typically deducted from the merchant’s bank account. If funds are unavailable or the merchant has gone out of business, Stax is now liable for the chargeback amount. In the case of fraudulent merchants, these amounts can be very large. Remember that chargebacks can occur up to 180 days after a transaction.

During a risk hold, we will request additional information on the transaction, such as the cardholder's invoice, job contract, and contact information. We will attempt to verify the cardholder’s identity and their authorization of the sale. Once these steps are completed successfully, we will release all funds in the merchant bank account, and funding will continue as normal.

Should you need to process a single transaction that exceeds your high ticket limit, please contact your Customer Success Manager or a member of our Customer Success team. In many cases, we can help accommodate these larger one-off sales by guiding them through our risk review process. Providing the customer information and invoice ahead of time can expedite this process and get you your funds more quickly.

Updated 7 months ago